OriginatorVault is a Mortgage Data Solution targeted at mortgage originators, lead generation firms, and title companies.

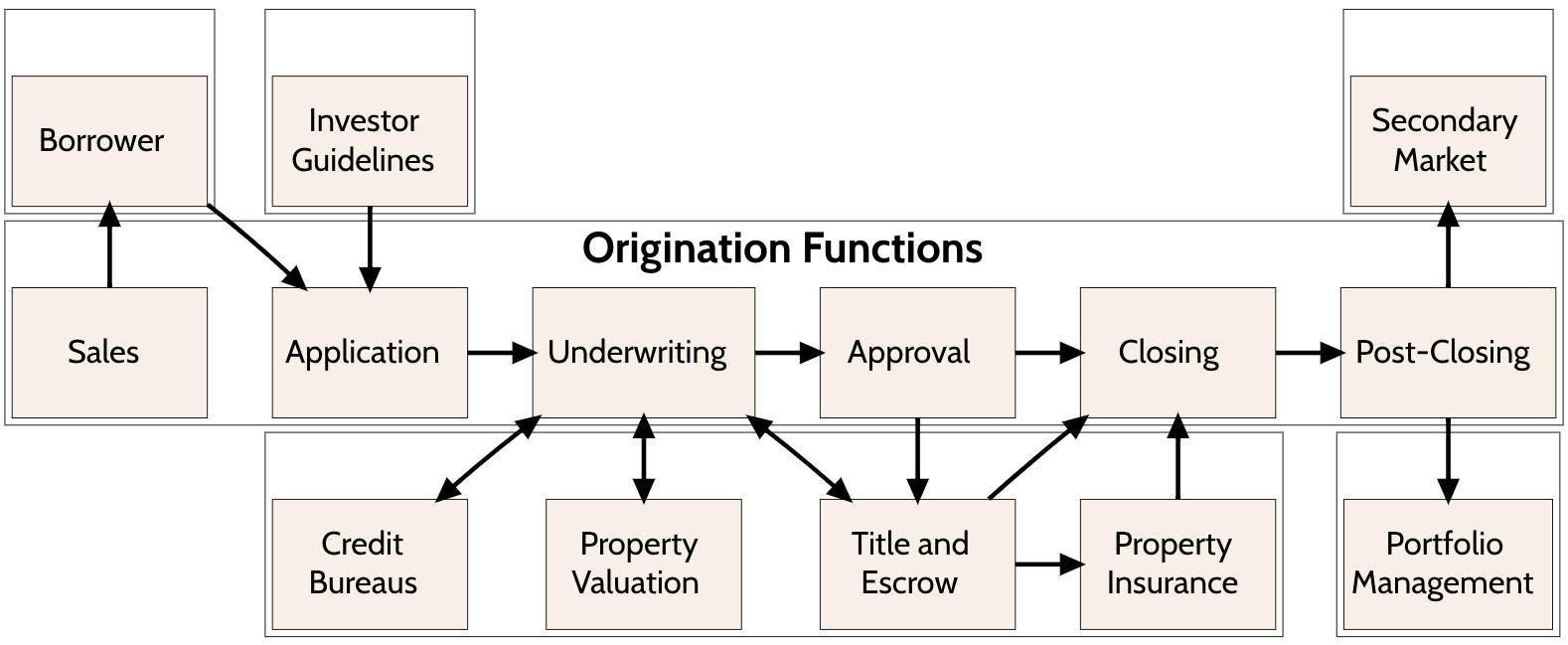

The mortgage origination process is extremely complex. Mortgage industry decision makers require data from a wide range of Operations, Management, and Customer systems in order to run their origination business efficiently and safely.

IndustryVault provides our OriginatorVault solution to ingest, transform, and access mortgage originations data in standardized yet customizable ways.

Ingest

The data in transactional systems is kept in a variety of storage technologies (SQL-based systems, mainframes, spreadsheets and more) with a wide range of purposes and designs. Unfortunately, most of these Data Sources are designed to support transactional use cases (e.g., originating a loan), not analytical use cases (e.g., assessing trends in loan officer compensation, etc.). Therefore, as a first step in building our Data Solutions, IndustryVault ingests data from these varying Data Sources into client-specific Data Warehouses.

IndustryVault uses best-in-class SaaS tools from ELT (extract-load-transform) vendors such as Fivetran, Stitch, and Airbyte, which combine the “extract” and “load” steps into a secure, automated ingest process. For systems that are not mortgage industry-specific (e.g., Salesforce, Zendesk, etc.), IndustryVault uses standardized connectors provided by the ELT vendors. However, for mortgage-specific systems (e.g., Encompass for originations), we use proprietary IndustryVault Connectors to precisely define the Extracts for each mortgage industry Data Source, and to accurately ingest Data Source-specific Extracts into client-specific Data Warehouses.

Transform

Once the ingest process successfully brings together in one location all of a Client’s Extracts from Operations, Management, and Customer Data Sources, IndustryVault then transforms these Extracts into business-centric information in various layers:

- Multiple Extracts stored in original formats loaded from various Data Sources (the “Lake");

- A single, clean, organized representation of each Client’s data (the “Warehouse”, or “single source of truth”);

- One or more functionally-organized subsets of this Warehouse (the “Marts"), heavily filtered and sometimes aggregated to make it easier for a particular team to query relevant data; and

- Industry-standard metrics, benchmarks, and scores (the “Analytics"), made available to decision makers through various forms of Reports.

Across each layer of all of our Data Solutions, IndustryVault provides a standardized mortgage-specific data model that we then can customize for each client. To make this process more scalable and consistent, we have developed proprietary IndustryVault Packages, which are sets of SQL-based libraries based on modularized code that enable our developers to spend more time focusing on our clients' unique business logic. For mortgage-specific datasets (e.g., Loan Quality datasets for originations), we use our proprietary IndustryVault Packages to transform raw data into trusted datasets for reporting, predictive modeling, and operational workflows.

IndustryVault also puts in place the appropriate governance for our clients' data throughout the ingest and transform processes. We use the open source Terraform project to manage our data infrastructure using code, using a simple, human readable language called HCL (HashiCorp Configuration Language). Terraform enables IndustryVault to manage a broad range of data resources, including cloud infrastructure (e.g., AWS, Azure), data platforms (e.g., Snowflake), reporting tools (e.g., Looker), etc.

From a business perspective, access to both the software AND the data is governed by a specific set of policies that we build into our proprietary IndustryVault Controls. These managed code-based governance policies ensure that all data, from raw datasets shared with investors to specialized analytics produced for reporting, is accessible only to permitted parties and uses.

Access

Once the transform process successfully produces the Warehouse, Marts, and Analytics required by end users, and places appropriate governance upon that data, IndustryVault then provides decision makers with contextually-appropriate access. We present datasets, metrics, and KPI’s from all layers of the data warehouse to decision makers in the appropriate format (e.g., dashboards, emails, etc.).

Our access process uses best-in-class SaaS tools from business intelligence and analytics vendors such as Looker and Microsoft to provide secure, version-controlled cloud-based access to data. IndustryVault organizes and presents mortgage-related information to make access easier for users, while still powerful for data analysts. We automatically measure content use for data owners and data stewards, and provide best-in-class APIs to support data application developers.

Similar to our approach to transforming data, IndustryVault reports on data using proprietary IndustryVault Templates to produce the most common reports used by originators. These standardized yet customizable dashboard templates cover 70-80% of a typical client’s operational reporting needs, freeing up time for data analysts to conduct more frequent, more timely ad-hoc analyses.